Roll With the Punchesįlexibility is key with managing any budget. He has money set aside and regularly adds to it for things like traffic and parking tickets, paying for an item broken in a store, and other similarly stupid things that we don’t normally plan to spend money on, but they come up anyway. My favorite example of this is Ramit Sethi’s “Stupid Shit” fund. So instead of panicking about needing to spend $1000 on a new laptop because yours just broke, instead you have a “new laptop” category where you sock away $100/month for a targeted replacement date. This rule teaches you to set up time-based “savings” goals to break that annual cost up into monthly chunks. We all have some big once-a-year costs that seem to pop up unexpectedly. The core of this rule is that there are no “normal months”. When you’re done with this step, you shouldn’t have any money showing as “to be budgeted” at the top.

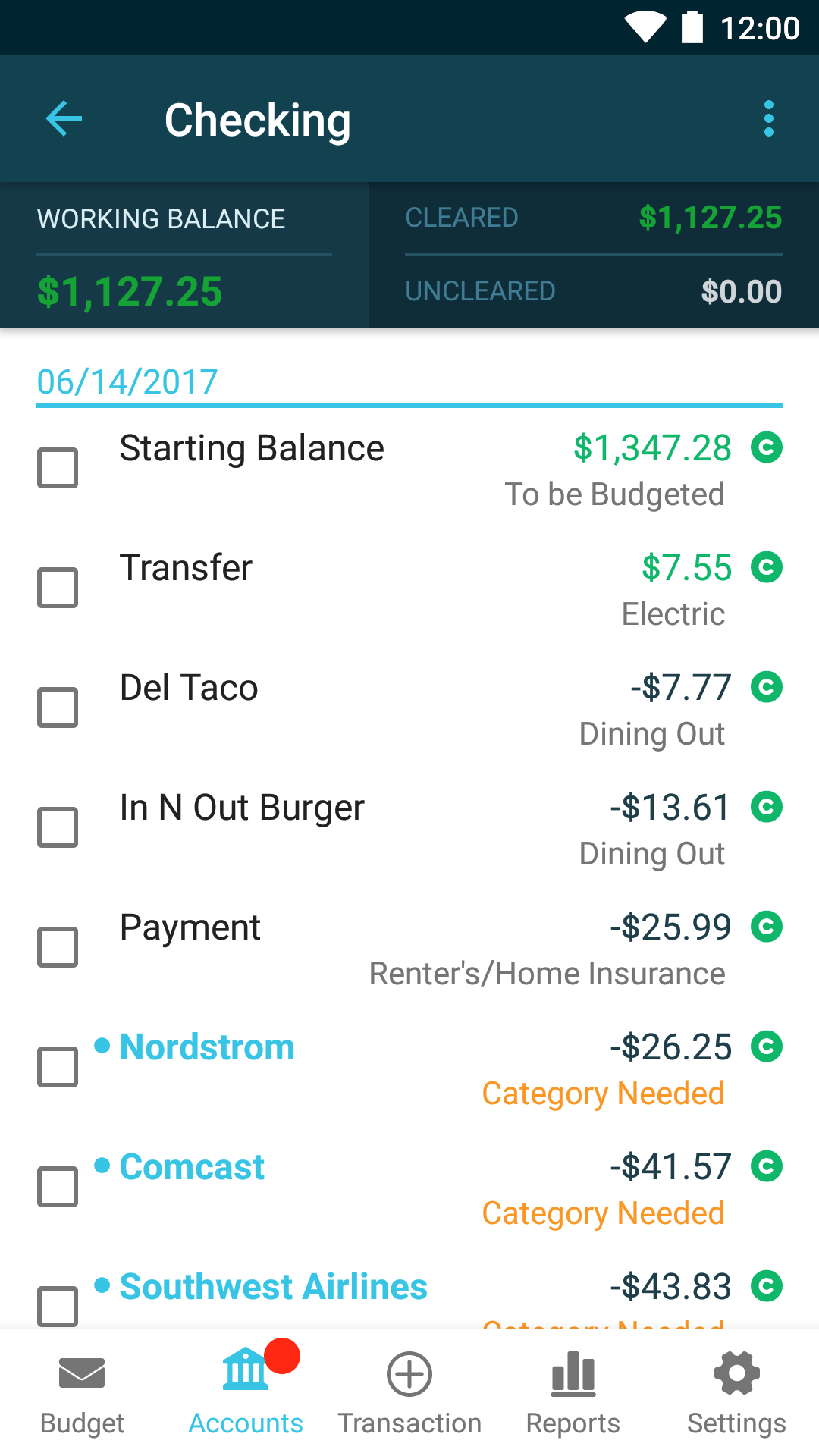

This lets you clearly see priorities and know exactly where your money is going. Give Every Dollar a JobĪs soon as a paycheck comes in, you assign every dollar to a budget category, whether for spending, saving, or future investing purposes. YNAB also teaches four core budgeting rules: 1. There are a few different types of budgeting, and YNAB is pretty much an electronic version of the envelope method. YNAB is an online budgeting tool that stands for “You Need A Budget.” Pretty self-explanatory, right? The reality is that no matter who you are or how much money you make, you really do need a budget… Even if it’s a basic accounting of where you plan to spend your money. But whatever the reason, I’ve found that I can spend hours fine-tuning our budget to maximize savings and plan for future financial goals. This probably stems from growing up sort of sheltered from my parents’ budgeting process and the skewed perception that came from dad handing us cash back at the grocery store whenever we asked for it. I have to admit that I’m a little obsessed with keeping track of my family’s financials. I used Mint in college, but in 2016 I switched to YNAB and have never looked back. Inspired Forward is an Amazon Affiliate partner.ĭo you budget? There are so many budgeting tools out there nowadays that it can sometimes feel like a hassle to pick one and just use it.

0 kommentar(er)

0 kommentar(er)